First-Time Home Buying Tips: Ready to dive into the world of real estate and purchase your first home? Get the inside scoop on everything you need to know to make the process smooth and successful.

From researching the market to setting a budget, understanding mortgage options, working with real estate agents, inspecting properties, making an offer, and more, this comprehensive guide has got you covered.

Researching the Market

Researching the real estate market before buying your first home is crucial to make an informed decision. It helps you understand property values, market trends, and factors that can affect your investment.

Analyzing Market Trends

- Look at recent sales data in the area to determine if property values are increasing, decreasing, or stable.

- Consider the average time properties stay on the market to gauge demand.

- Check for any upcoming developments or infrastructure projects that could impact property values.

Role of Location and Amenities

- Location plays a significant role in property values, so consider factors like proximity to schools, transportation, and shopping areas.

- Evaluate the amenities in the neighborhood, such as parks, restaurants, and recreational facilities, which can enhance your quality of life.

Future Development

- Research potential future developments in the area, like new businesses or public transportation projects, that could increase property values.

- Consider the overall growth potential of the neighborhood to ensure your investment will appreciate over time.

Setting a Budget: First-Time Home Buying Tips

Setting a budget is a crucial step in the process of buying your first home. It helps you determine how much you can afford and ensures you stay within your financial means.

Discussing the financial aspects of setting a budget, it’s important to consider various factors such as down payments, closing costs, and monthly mortgage payments. These elements play a significant role in determining the overall cost of purchasing a home.

Importance of Pre-Approval for a Mortgage

When setting a budget for your first home purchase, obtaining pre-approval for a mortgage is essential. This process involves a lender evaluating your financial situation and determining the maximum amount they’re willing to lend you. Pre-approval gives you a clear idea of your budget and allows you to shop for homes within your price range.

- Pre-approval helps you understand your financial limits and prevents you from overspending on a home.

- It gives you an advantage when making an offer on a property, as sellers prefer buyers who are pre-approved for a mortgage.

- Knowing your pre-approved amount helps you narrow down your search and focus on homes that fit your budget.

Understanding Mortgage Options

When it comes to buying your first home, understanding the different mortgage options available is crucial. Mortgages are essential for most first-time homebuyers, as they provide the necessary funds to purchase a house while spreading out the payments over time.

Fixed-Rate Mortgages

Fixed-rate mortgages are popular among first-time homebuyers because they offer stability and predictability. With a fixed-rate mortgage, your interest rate remains the same throughout the life of the loan, making it easier to budget and plan for your monthly payments. While the initial interest rate may be slightly higher than an adjustable-rate mortgage, you won’t have to worry about your payments increasing in the future.

Adjustable-Rate Mortgages

On the other hand, adjustable-rate mortgages (ARMs) typically start with a lower interest rate than fixed-rate mortgages. However, the interest rate on an ARM can change periodically based on market conditions, which means your monthly payments could increase over time. ARMs are riskier than fixed-rate mortgages, but they can be a good option if you plan to move or refinance before the introductory period ends.

Importance of Interest Rates, Loan Terms, and Down Payment Requirements, First-Time Home Buying Tips

When choosing a mortgage, it’s essential to consider the interest rate, loan terms, and down payment requirements. A lower interest rate can save you thousands of dollars over the life of the loan, so it’s crucial to shop around and compare rates from different lenders. Additionally, the length of the loan term and the amount of your down payment can impact your monthly payments and overall cost. A larger down payment can help you secure a better interest rate and reduce the amount of interest you pay over time.

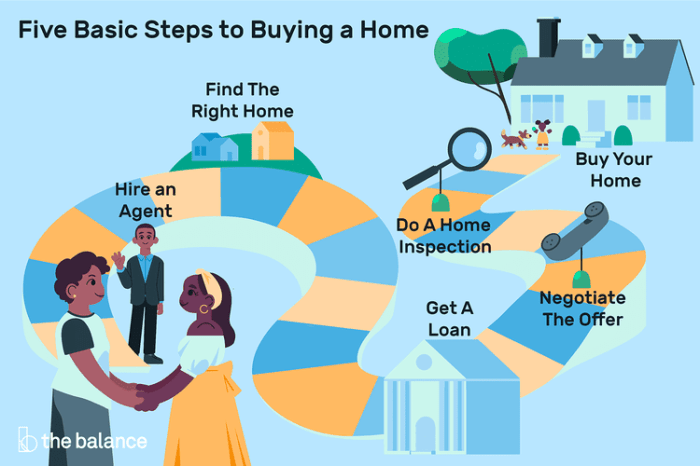

Working with Real Estate Agents

When it comes to buying your first home, having a reliable real estate agent by your side can make all the difference. A good agent can help you navigate the complex process of purchasing a property and ensure that you find the perfect home for you and your family.

Choosing a Reliable Real Estate Agent

- Look for agents with positive reviews and a proven track record of successful transactions.

- Ask for recommendations from friends and family who have recently purchased a home.

- Interview multiple agents to find someone who understands your needs and communicates well.

Role of a Buyer’s Agent

A buyer’s agent works exclusively on behalf of the buyer, representing their best interests throughout the home-buying process.

- Helps you find suitable properties based on your preferences and budget.

- Negotiates with sellers on your behalf to get the best deal possible.

- Guides you through the closing process and ensures all necessary paperwork is in order.

Benefits of Professional Guidance

Working with a real estate agent can save you time, money, and stress during the home-buying process.

- Agents have in-depth knowledge of the local market and can help you make informed decisions.

- They have strong negotiation skills to secure the best price for your dream home.

- Agents handle all the paperwork and legalities, ensuring a smooth and hassle-free transaction.

Inspecting Properties

When viewing potential properties, it’s crucial to inspect various aspects to ensure you’re making an informed decision. Home inspections play a vital role in uncovering hidden issues that could potentially cost you money in the long run. Additionally, considering resale value and future maintenance costs during property inspections can help you make a wise investment.

Checklist of Essential Aspects to Inspect

- Structural integrity of the property

- Roof condition and age

- Plumbing system

- Electrical system

- Heating and cooling systems

- Appliances included in the sale

- Presence of mold or other environmental hazards

Importance of Home Inspections

Home inspections are essential as they can reveal underlying issues that may not be visible during a casual viewing. Identifying these problems early on can help you negotiate repairs or price adjustments with the seller, saving you from unexpected expenses down the line.

Considering Resale Value and Future Maintenance Costs

During property inspections, it’s important to assess the resale value of the home. Factors such as location, neighborhood amenities, and potential for future appreciation should be taken into account. Additionally, considering future maintenance costs, such as replacing the roof or upgrading appliances, can help you budget effectively and avoid financial strain in the future.

Making an Offer

When it comes to making an offer on a property, it’s important to strike a balance between being competitive and reasonable. You want to show the seller that you are serious about purchasing the home, but you also want to make sure you are not overpaying.

Negotiation Strategies

- Do your research on comparable properties in the area to determine a fair market value for the home.

- Consider including a personal letter to the seller to express your interest in the property and why you would be a good fit as the new homeowner.

- Work closely with your real estate agent to craft an offer that is attractive to the seller while still protecting your own interests.

Navigating Counteroffers

- Be prepared for the possibility of receiving a counteroffer from the seller. Stay calm and consider each counteroffer carefully before responding.

- Consult with your real estate agent to develop a counteroffer strategy that aligns with your budget and goals.

- Remember that negotiation is a give-and-take process, and be willing to compromise on certain terms to reach a mutually beneficial agreement.

Importance of Contingencies

- Include contingencies in your offer to protect yourself in case something unexpected arises, such as issues found during the home inspection or problems with financing.

- Common contingencies include the appraisal contingency, financing contingency, and home inspection contingency.

- These clauses give you the option to back out of the deal if certain conditions are not met, providing you with peace of mind throughout the buying process.